Contents

A balance sheet can be presented in two formats – report form and account form. It assists in the rectification of errors and makes due adjustments. Such adjustments are relevant only for the particular accounting https://1investing.in/ year. Trial balance also helps in the comparative analysis with a previous year’s balances and the current one. Enter in the debit column of the ledger account the amount of the debit as shown in the journal.

- There should be some documentary evidence of each transaction.

- As data entry systems do not allow entries to be posted if there is a difference in the debit and credit amount hence leaving no room for error.

- There are three types of accounts, i.e., personal, real and nominal.

- With softwares being used for preparation of accounts, today the Trial Balance from ERP system has automated a lot of processes.

- If there are offsetting errors, the Trial Balance will tally despite the error.

Representative personal accounts When an account represent a certain person, it is called representative personal account. Therefore, salaries outstanding a/c is a personal account because it represents certain persons. Similarly, insurance prepaid a/c, rent outstanding a/c, interest accrued a/c, etc. are personal accounts. Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources.

Steps to prepare the trial balance sheet:

It is used for the verification of actual amounts from various ledgers. It also leads to the determination of the balances of all ledger accounts, which are eventually used for the financial statements. Once the trial balance has been prepared, the accountant can use it to identify any accounts that may need further review or analysis.

Bad debts are the organisation’s debts that are either irrecoverable or uncollectable. In business terms, bad debts are a loss to the company and hence should be limited. It is transferred to the loss side of the P&L account and is also reflected in the Trial Balance sheet as an entry recoverable from its profits.

The recording of the debit in the ledger account is now complete. Return to the journal and enter in the ledger folio column, the number of the ledger page to which the debit was posted. Generally there is a confusion regarding some of nominal accounts and personal accounts. A simple rule is that when a prefix or suffix is added to a nominal account, it becomes a personal account. For example, wages a/c is a nominal a/c but wages outstanding a/c is a personal a/c. Similarly, rent a/c and insurance a/c are nominal accounts but rent paid in advance a/c and unexpired insurance a/c are personal accounts.

If needed, such trial balance sheets can also be drawn monthly, half-yearly, quarterly, or even weekly. The balance sheet only displays personal and real accounts. Dedicated columns of debit and credit are displayed in a trial balance. A trial balance is a summary sheet listing all ledges and balances. Hence it provides a bird eye view of the accounting transactions of an organisation.

Importance of Trial Balance

Despite the numerous benefits of a Trial balance, it is imperative to understand that a tallied Trial Balance does not ensure zero errors. If there are offsetting errors, the Trial Balance will tally despite the error. Reserves in funds, depreciation provisions, general reserves, accumulated depreciation on plant and machinery, trial balance under the audit period will be filed in etc. It is the foundation stone of all account statements and the connecting bridge between the Profit and Loss Account, Books of accounts, and the Balance sheet. The proper arrangement of the assets, liabilities, and stockholder’s equity is necessary. Trial balance acts as the source while working on a balance sheet.

Preparing the various financial statements like the P&L account, balance sheet, other financial statements, accounting records, etc. Profit and Loss Account and Balance Sheet are prepared on the basis of trial balance data and additional information. It is a preliminary book to provide a chronological record of transactions in which each transaction is recorded with relevant supplementary information. Journal is known as a book of original entry because the transactions are first recorded in journal and it is from this record that various accounts are posted in the ledger. The process of recording transactions in journal is known as journalising. In this, the balance of every ledger is combined into credit and debit account column totals that are always equal.

Profit or loss is difference of Earning and Expenses during accounting period. Having a corresponding credit entry and vice versa, the trial balance, when right, must always tally. In case of any differences in the balances, you must undertake trial balance error rectification through an audit of the accounts.

The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc. The cardinal rule of the trial balance is that the total of the trial balance debit and credit accounts and ba lances taken from the ledgers should be the same or tallied. This is because every transaction has a credit and debit entry or an effect with dual consequences. If not, there is an error or inaccuracy in the ledger entries. It is the primary account statement from which several financial statements like the Balance sheet or P&L or Trading and Profit & Loss account and more are prepared.

These documents reveal that transactions have occurred and initiate the accounting process. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

These errors occur when two or more same value accounts occur on both the credit and debit sides. For example, instead of debiting the Fixed Asset account by Rs 50,000/-, the Sales is provided Rs 50,000/-. It is a very important part of the financial statements and financial accounts.

3 Nominal Account v. Personal Accounts

JF column denotes the page number on which journal entry of this transaction has been recorded. There are three types of accounts, i.e., personal, real and nominal. On the basis of documentary evidences, the accountant makes a record of a transaction in journal in chronological order. There should be some documentary evidence of each transaction.

Its objective is to prove the arithmetic accuracy of its entries since, in a Trial balance, the credit and debit balances are equal. It does not verify the inaccuracies, however, which requires an audit to prove inaccuracies in the credit/debit balances. Assessing the ledger accounts’ arithmetical accuracy when the total credit is equal to the total debt. The trial balance can display real, personal, and nominal accounts. The sheet recording all of the balances of the general ledger accounts is known as the trial balance. The accounting process is a series of steps that begin with a transaction taking place and ends with closing of the account books at the end of the year.

In this case, the accountant must identify and correct the problem before preparing the financial statements. The total of the debit balances is then compared to the total of the credit balances. But, with business needs becoming more diverse, financial statements are needed to be in alignment with business health and funding so that effective decisions can be made. This is also a more efficient, reliable, accurate way of recording transactions digitally while saving effort, time, resources, and more.

It may be a bound book or a set of loose leaf pages or punched cards. Each account is opened on a separate page or card in the ledger. Two or more accounts to be debited and two or more accounts to be credited. One account to be debited and two or more accounts to be credited. Ledger Folio means the page numbers of the ledger in which these accounts appear in the ledger.

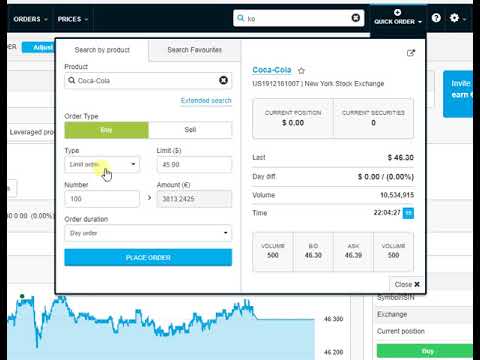

Format of trial balance:

To prepare a trial balance, the accountant first gathers all the account balances from the general ledger and lists them in a trial balance worksheet. The importance of balance as a part of a company’s financial statement can be understood along with the documents of cash flow and income statements. All of these combined together help in indicating the financial position of the company to the interested parties. It imparts the information about what the company owes and owns. Due to this fact, a balance sheet is also referred to as “Statement of financial position”. This financial statement pertains to a particular date which is usually the accounting period’s last date.

Understanding Trial Balance

Check for any unrecorded transactions or errors that may have been made in the accounting records. In addition to verifying the accuracy of the account balances, the trial balance is also useful for identifying any accounts that may need further review or analysis. For example, if an expense account has a significantly higher balance than in previous periods, it may be worth investigating to determine the cause of the increase. Profit or loss will not come in trial balance it will come only in profit and loss account and carried over profit or loss in balance sheet. As shown above, the ledger accounts are mentioned in the first column, and their various entries are shown as credit or debit entries in the respective columns.

The content/information published on the website is only for general information of the user and shall not be construed as legal advice. Every account in the ledger has a name which is written at the top of the account. Accounts of artificial persons and body of persons e.g., partnership firm’s a/c, company’s a/c, bank a/c, club’s a/c, insurance company’s, etc. Credit Amount In this column, amount to be credited is entered. Debit Amount In this column, amount to be debited is entered.

The main purpose is to detect if there are any numerical errors that might have occurred while the double-entry system of accounting. Date This column records the date when transaction is entered in journal. Of these five steps, first four steps are discussed in this chapter and the last step i.e. final accounts is discussed in a subsequent chapter. Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP.